The Vitaly Absolute Price-to-Earnings (P/E) Model is a valuation method that offers a more robust and adaptable approach to determining the fair value of a stock. Designed by renowned investor and financial thinker Vitaly Katsenelson, the model seeks to overcome the limitations of the traditional P/E ratio by integrating multiple factors that influence a company’s long-term performance. This method is particularly useful for navigating volatile or uncertain markets, where traditional metrics may fail to provide an accurate picture.

In this article, we’ll break down the key elements of the Vitaly Absolute P/E Model, how it differs from conventional P/E analysis, and why it can be a powerful tool for investors.

What is the Traditional P/E Ratio?

Before diving into the Vitaly Absolute P/E Model, it’s important to understand the conventional Price-to-Earnings (P/E) ratio and its limitations. The P/E ratio is one of the most commonly used metrics to evaluate a stock’s value. In simple terms, the P/E ratio tells you how much investors are willing to pay for each dollar of a company’s earnings. While this ratio is widely used, it has significant drawbacks, especially when assessing companies in different phases of their growth or in volatile market environments.

Limitations of the Traditional P/E Ratio:

- Ignores Growth: The traditional P/E ratio doesn’t account for a company’s future growth prospects, which means it might undervalue high-growth companies or overvalue those that have peaked.

- Market Sentiment Bias: The P/E ratio can be heavily influenced by short-term market sentiment, making it less reliable in volatile times.

- Not Suitable for Non-Profitable Companies: Companies with no earnings or negative earnings cannot be evaluated using the traditional P/E ratio.

What is the Vitaly Absolute P/E Model?

The Vitaly Absolute P/E Model takes a more dynamic approach by considering not just the company’s current earnings, but also growth rates, risk factors, and broader market conditions. Instead of applying a static multiple (like in the traditional P/E ratio), the model adjusts the P/E ratio based on a variety of company-specific and macroeconomic factors.

Key Components of the Vitaly Absolute P/E Model:

- Base P/E Ratio: This starts with a baseline P/E ratio, which is typically the historical average or market-average multiple.

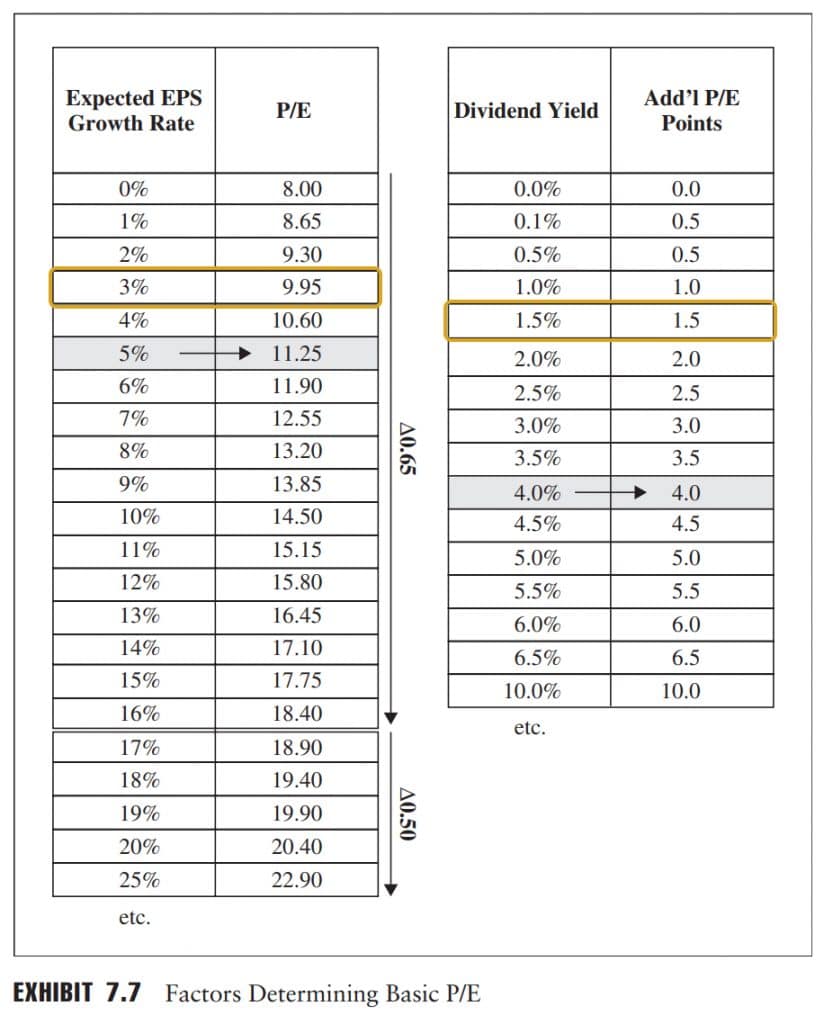

- Earnings Growth Adjustment: Unlike the traditional P/E model, Vitaly’s model adjusts for expected growth. A company with higher expected earnings growth will be assigned a higher P/E ratio, while a company with slower growth will receive a lower multiple.

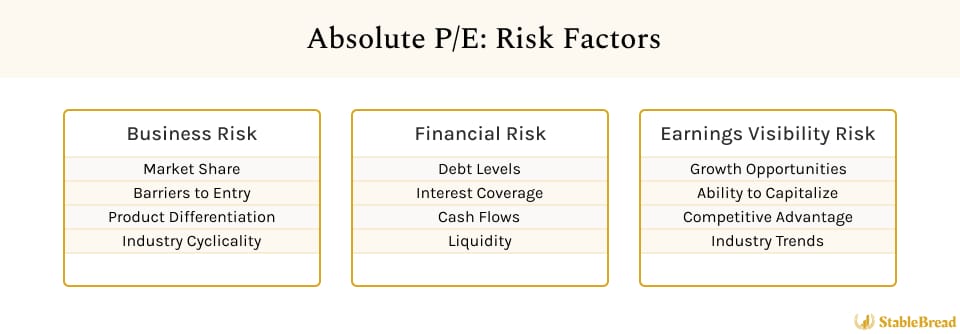

- Risk Adjustments: The model accounts for both company-specific and market risks. A higher-risk company will have its P/E multiple reduced to reflect the potential for more volatile earnings or market conditions.

- Market Sentiment and Interest Rates: The Vitaly Absolute P/E Model also considers broader economic indicators, such as interest rates and market sentiment, which can affect stock valuations. In times of low interest rates, for example, the acceptable P/E ratio may be higher because investors are more willing to pay for future earnings.

- Cyclicality: For cyclical industries, the model adjusts the P/E ratio based on where the company or industry is in the business cycle. This ensures that companies in industries like energy or automotive are not overvalued during boom times or undervalued during recessions.

The Formula for the Vitaly Absolute P/E Model

The Vitaly Absolute P/E model doesn’t have a single standardized formula like the traditional P/E ratio, but instead involves a step-by-step adjustment process. Here’s an overview of how it works in practice:

- Start with a Base P/E Ratio: Usually, this is the long-term historical P/E ratio of the market, which might be around 15x.

- Adjust for Growth: Add or subtract from the base P/E depending on the company’s growth prospects. Higher growth can add several points to the P/E ratio, while low or negative growth reduces it.

- Adjust for Risk: A riskier company will have its P/E ratio reduced. Factors like financial leverage, market volatility, or competitive pressures come into play here.

- Interest Rate and Macro Adjustments: In a low-interest-rate environment, the baseline P/E is typically adjusted upwards to account for the relatively cheap cost of capital, while high-interest rates will suppress the P/E ratio.

- Final P/E: Once these factors are all accounted for, you arrive at the final adjusted P/E ratio, which can then be applied to the company’s current earnings to estimate its fair value.

Benefits of Using the Vitaly Absolute P/E Model

More Comprehensive Valuation:

- Unlike the traditional P/E ratio, which only looks at price and earnings, the Vitaly Absolute P/E model provides a more nuanced view by considering growth, risk, and external market factors. This makes it a more accurate and flexible tool for valuing companies.

Accounts for Growth and Risk:

- By adjusting for earnings growth and risk, the model avoids the pitfalls of overvaluing high-risk companies or undervaluing high-growth firms. This is particularly important when evaluating companies in fast-evolving industries like tech or biotech.

Adapts to Market Conditions:

- The Vitaly Absolute P/E Model also adapts to broader market conditions, making it more reliable in times of economic uncertainty. For example, in times of low interest rates or recession, the model can help prevent overpaying for stocks that may have inflated P/E ratios due to temporary market conditions.

Ideal for Long-Term Investors:

- Since the model takes a more long-term, fundamental approach to valuation, it’s well-suited for investors who are looking for sustainable returns rather than short-term gains based on market fluctuations.

Limitations of the Vitaly Absolute P/E Model

Despite its advantages, the Vitaly Absolute P/E Model is not without limitations:

- Complexity: The model requires more detailed information and analysis than the simple P/E ratio. Adjustments for growth, risk, and macro conditions require subjective judgment, which may introduce bias.

- Not Suitable for Every Company: In cases where a company’s growth prospects are highly uncertain or where earnings are volatile, the model might not provide a precise valuation.

- Dependent on Forecast Accuracy: Since the model relies on earnings forecasts and assumptions about growth and risk, its accuracy depends on the quality of these inputs.

Why Use the Vitaly Absolute P/E Model?

The Vitaly Absolute P/E Model offers a sophisticated and dynamic approach to stock valuation, providing a more accurate reflection of a company’s true value. By adjusting for growth, risk, and broader economic conditions, the model is especially valuable in volatile markets or when evaluating companies with varying levels of risk and growth potential.

For long-term investors seeking to make informed decisions, the Vitaly Absolute P/E Model provides a deeper level of insight compared to the traditional P/E ratio, making it a powerful tool in your investment arsenal. However, it requires a more nuanced understanding of market conditions and company fundamentals, which means it’s best suited for investors willing to engage in detailed analysis.